Smart Investors Stay Ahead.

Access select insights, thought leadership, and research on where private markets are headed.

Deal Flow Secrets: Building a Robust Network to Access Oversubscribed Rounds

Securing allocations in oversubscribed private market deals can feel like hunting for unicorns—everyone wants in, but spots are limited. From competitive late-stage funding rounds to hot pre-IPO placements, elite deal flow is often gated by exclusive relationships and insider networks. So, how do the most successful investors consistently access these high-potential opportunities? In this post, […]

Exit Strategies Unlocked: IPOs, Secondaries, and Strategic Sales Explained

One of the most compelling aspects of private market investing—particularly in late-stage or growth equity deals—is the promise of a significant exit. Whether it’s an initial public offering (IPO), a secondary transaction, or a strategic sale, choosing the right exit path can dramatically affect an investor’s overall returns. Yet, these processes can be complex, often […]

From Term Sheets to Signed Deals: A Step-by-Step Guide for Private Investors

Negotiating a private market deal can feel like navigating a maze of legal documents, valuation debates, and last-minute surprises. Whether you’re investing in a late-stage tech startup or a niche manufacturing firm, clarity and due diligence are paramount to protect your capital and build trust with founders. This post breaks down the step-by-step process from […]

Future-Proof Your Portfolio: How Strategic Private Investments Complement Public Holdings

For many investors—ranging from high-net-worth individuals to institutional fund managers—public equities and bonds form the backbone of a traditional portfolio. While these instruments offer liquidity and transparency, they’re also subject to market volatility and can limit growth potential once a company’s main expansion phase is already priced in. Enter strategic private investments: a way to […]

Going Global: The Rise of Cross-Border Private Investments

Private market investing is no longer confined to a single region or country. Today, cross-border private investments offer a compelling way to access high-growth markets, diversify portfolios, and tap into emerging consumer bases. Yet, going global also involves navigating cultural nuances, regulatory complexities, and currency risks. In this post, we’ll explore how investors can seize […]

How to Spot the Next Unicorn: Key Indicators of High-Growth Startups

For private market investors, finding the next unicorn—a startup valued at $1 billion or more—can transform a portfolio. These high-growth companies often generate outsized returns, validating early backers who took the plunge before mainstream recognition. But identifying a potential unicorn in its nascent stages requires more than just luck. It demands keen insight, rigorous due […]

Investor Advocacy Beyond the Deal: Ensuring Alignment Through Exits and Beyond

When it comes to private market transactions—whether venture capital investments or late-stage private equity placements—much of the focus revolves around deal negotiation and closing. Yet, the real work of investor advocacy doesn’t stop once the ink is dry on the term sheet. From strategic guidance and board-level engagement to shaping exit opportunities, effective advocacy can […]

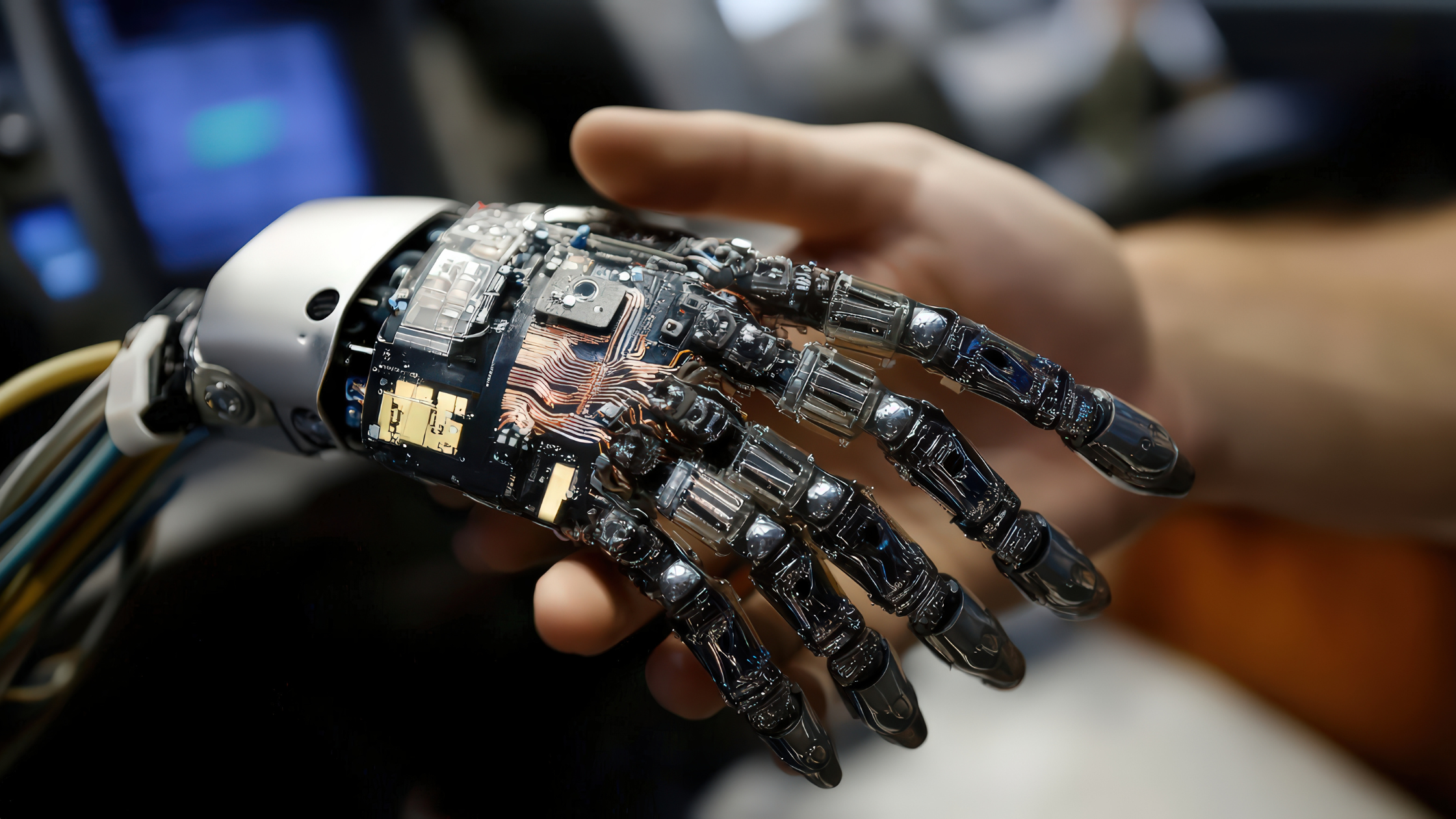

Leveraging AI and Analytics in Private Equity: A New Age of Data-Driven Decisions

Private equity has long been about relationships, expert judgment, and strategic intuition—but the landscape is evolving fast. Artificial intelligence (AI) and advanced analytics are now unlocking new efficiencies, improving due diligence accuracy, and helping investors uncover hidden value across their portfolios. In this post, we’ll dive into how AI and analytics are reshaping deal sourcing, […]

Making Sense of Market Cycles: Private Equity Opportunities in Boom and Bust Times

Every market goes through cycles—periods of expansion (boom) and contraction (bust). While public market investors often track these cycles through stock indices or GDP growth, private equity (PE) investors face unique dynamics. Deals can be illiquid, valuations opaque, and timelines much longer. Yet, understanding and adapting to market cycles can spell the difference between outsized […]

Market Trends 2025: Navigating Generative AI, Cloud Security, and More

Private market investing has always demanded a forward-looking lens. By the time an emerging technology becomes mainstream, the biggest opportunities may have passed. That’s why savvy investors strive to identify, understand, and capitalize on macro trends before they dominate headlines. In 2025, several high-impact arenas—generative AI, cloud security, climate technology, and beyond—are converging to reshape […]